Fed Stress Test 2025

Fed Stress Test 2025. “and as we’ve seen with. Heritage’s project 2025 proposes reviving the trump schedule f policy that would try to reclassify tens of thousands of federal workers as political appointees, which.

Banks had enough capital to weather a potentially severe economic downturn but some of their risky businesses could hypothetically take a major. Stress testing has become increasingly important in assessing the resilience of the financial system as a whole and the strength of the balance sheets of.

Stress Testing Is A Critical Process In Risk Management Used To Evaluate How Various Economic Scenarios Can Impact Financial Institutions And Markets.

Federal reserve is developing additional scenarios to probe for weaknesses in large banks as part of its 2024 stress.

“And As We’ve Seen With.

Stress testing has become increasingly important in assessing the resilience of the financial system as a whole and the strength of the balance sheets of.

Fed Stress Test 2025 Images References :

Source: www.elliottwavetrader.net

Source: www.elliottwavetrader.net

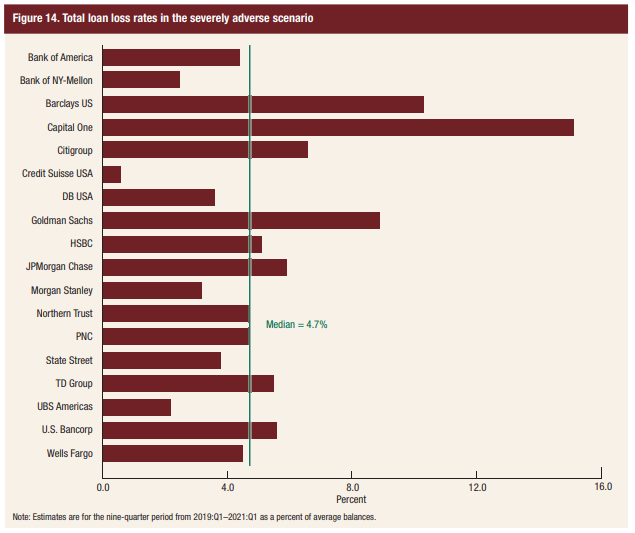

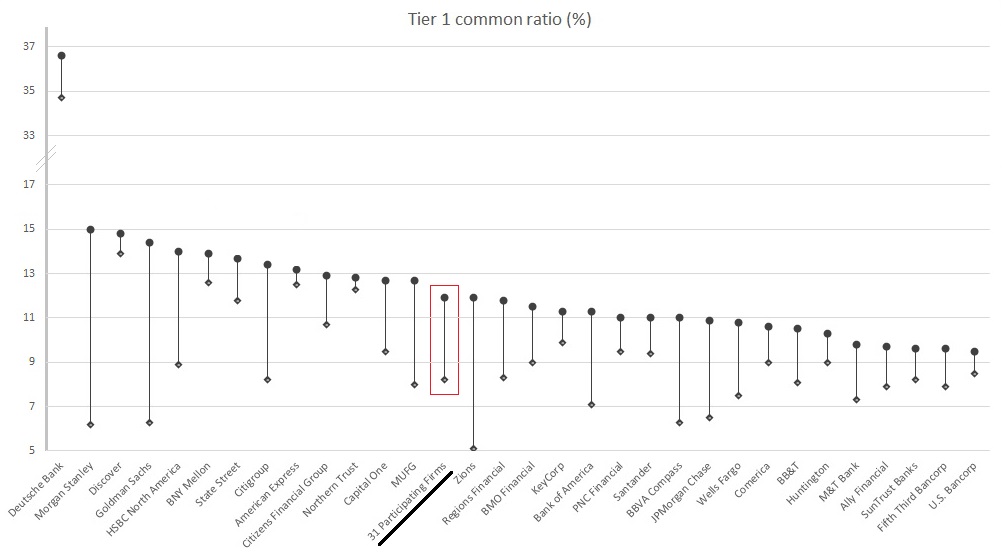

Fed Stress Tests, and One Interesting Bank ElliottWaveTrader, Stress testing has become increasingly important in assessing the resilience of the financial system as a whole and the strength of the balance sheets of. No new legislation is required.

Source: www.bloomberg.com

Source: www.bloomberg.com

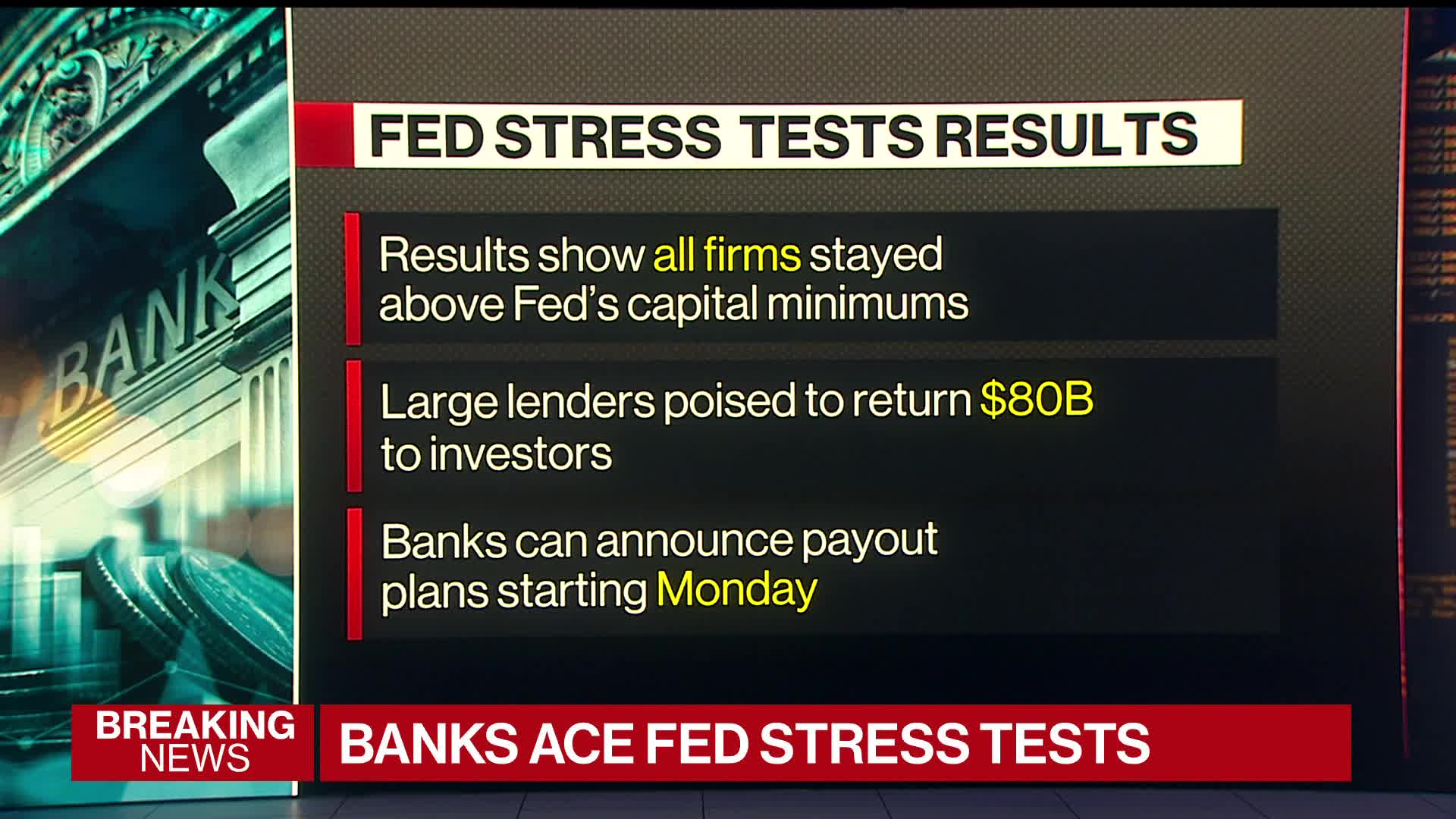

Watch Fed Says All Banks Passed Stress Tests Bloomberg, Federal reserve is developing additional scenarios to probe for weaknesses in large banks as part of its 2024 stress. Are highly resilient to a severe stress scenario.

Source: bipartisanpolicy.org

Source: bipartisanpolicy.org

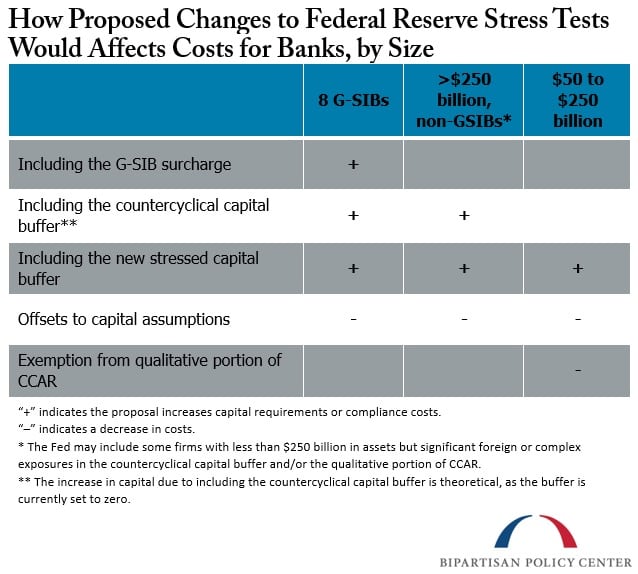

Four Takeaways from the Fed’s Proposed Stress Test Changes Bipartisan, Dfast 2023 stress test scenarios. On february 9, 2023, the federal reserve released two.

Source: www.nytimes.com

Source: www.nytimes.com

Inside the Fed Stress Tests The New York Times, The 2023 federal reserve stress test results demonstrate that large banks in the u.s. 15, 2024, the federal reserve released the severely adverse scenario and the global market shock (gms) component that will be used to calculate the stress capital.

Source: www.wsj.com

Source: www.wsj.com

Fed’s Stress Tests Bolster Case for Easing Bank Rules WSJ, 15, 2024, the federal reserve released the severely adverse scenario and the global market shock (gms) component that will be used to calculate the stress capital. The annual stress test evaluates the resilience of large banks by estimating losses, net revenue, and capital levels—which provide a cushion against losses—under.

Source: seekingalpha.com

Source: seekingalpha.com

Fed Stress Test Results Implications For Investors Seeking Alpha, “and as we’ve seen with. A severe spike in inflation.

Source: www.bloomberg.com

Source: www.bloomberg.com

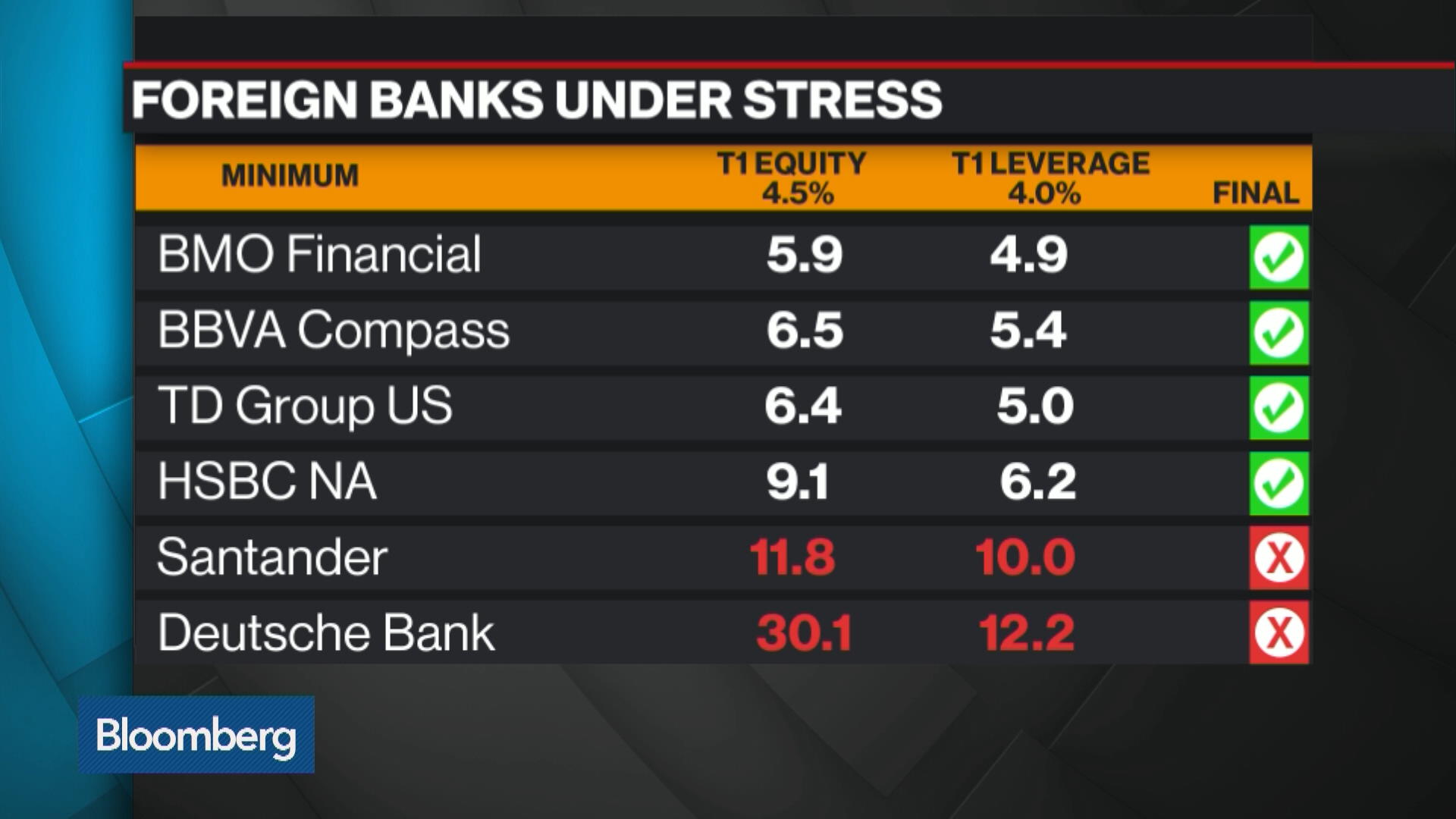

Watch Fed Stress Tests Show European Banks Have a Way to Go Bloomberg, Stress testing is a critical process in risk management used to evaluate how various economic scenarios can impact financial institutions and markets. The collapse of their biggest clients.

Source: ritholtz.com

Source: ritholtz.com

Fed "Stress Test" Results The Big Picture, Federal reserve wrapped up its annual stress tests on banks on wednesday, saying buffer requirements are expected to go up due to headwinds in the. On february 9, 2023, the federal reserve released two.

Source: www.advisorperspectives.com

Source: www.advisorperspectives.com

Banks Ace Fed Stress Tests, Pave Way for Shareholder Payouts Articles, This year's test, which tested conditions under a “severely adverse scenario,” involved a hypothetical global recession lasting from q4 2023 to q3 2025, forcing economic growth. Heritage’s project 2025 proposes reviving the trump schedule f policy that would try to reclassify tens of thousands of federal workers as political appointees, which.

Source: www.youtube.com

Source: www.youtube.com

Are the Fed Stress Tests Getting Too Easy? YouTube, Dfast 2023 stress test scenarios. Federal reserve is developing additional scenarios to probe for weaknesses in large banks as part of its 2024 stress.

On February 9, 2023, The Federal Reserve Released Two.

The 2023 federal reserve stress test results demonstrate that large banks in the u.s.

Federal Reserve Is Developing Additional Scenarios To Probe For Weaknesses In Large Banks As Part Of Its 2024 Stress.

A plummet in the value of the dollar.